AI in Finance: Getting Started with ChatGPT or Copilot

The AI buzz is everywhere, and so is the unprecedented shadow of FOMO (fear of missing out). As AI tools become more accessible, the status

The AI buzz is everywhere, and so is the unprecedented shadow of FOMO (fear of missing out). As AI tools become more accessible, the status

As a CFO evaluating the efficiency of your financial reporting system, there are several key factors to consider. These factors help determine whether the system

Financial reporting refers to the process of preparing and presenting financial information about a company’s performance and financial position to external stakeholders, such as investors,

For companies with complex reporting needs like multi-company consolidations, nothing will compromise a financial close like spreadsheets. For many that rely on Excel-based reporting processes,

With the new year comes a new era in financial reporting. The financial industry is dynamic with new trends continually emerging. The summary below includes

Naples, FL, USA – September 12, 2023 – FYIsoft, a provider of cloud-based solutions for financial reporting, analytics, and budgeting, today announced the availability of

One of the most memorable moments of the 2022 Summit Keynote address was the big announcement: GP has joined the list of legacy Microsoft ERPs

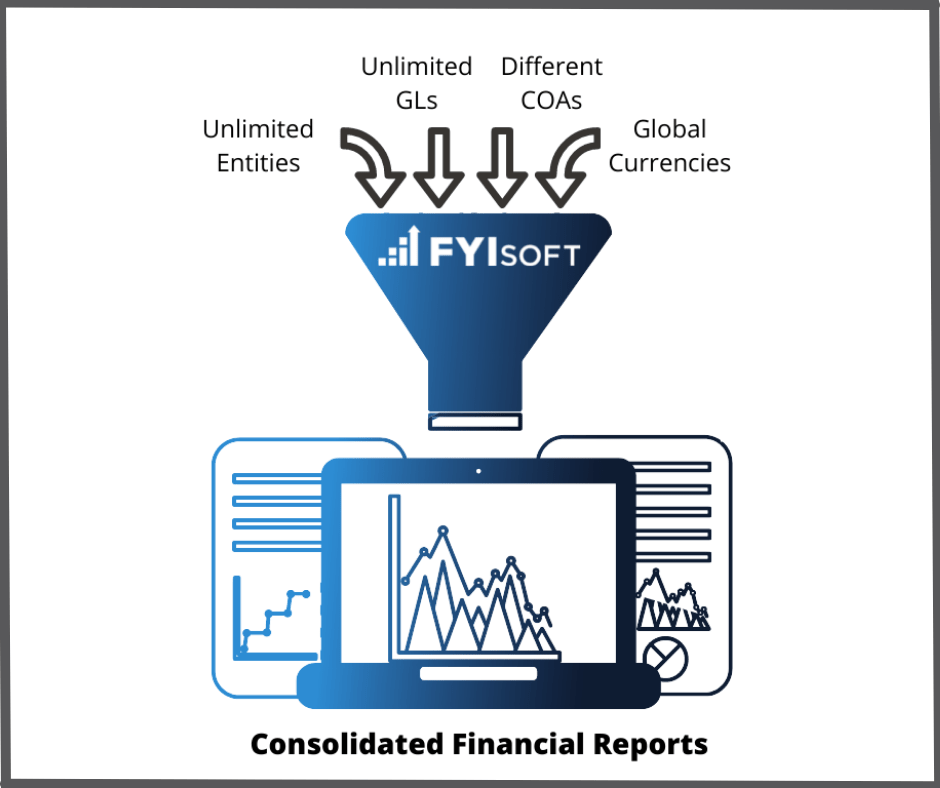

If you are exploring financial reporting and FP&A solutions, you are probably familiar with the growing popularity of the phrase, “multiple GL consolidation.” It’s true

Naples, FL – May 3, 2022 – FYIsoft’s suite of financial reporting and FP&A solutions integrate with many ERP systems to deliver the modern automation

Naples, FL – May 2, 2022 – FYIsoft, a provider of financial reporting and FP&A software, announces three new product releases completed during the first