In our last blog post, we explored why organizations need to budget, this week we will explore four best practices as a company enters budget season.

Messaging. Setting the tone from the top of the house ensures that everyone hears and interprets the same messaging around budgeting intent and expectations. Make no mistake, budgeting is NOT solely a finance exercise. It is crucially strategic, and everyone should be empowered to be a cost manager.

Project Management. The optimal image here is ‘herding kittens.’ While that image is somewhat hyperbolic, sometimes managing a budget can feel a bit like that. But one thing to remember here – you make the rules. Herd your kittens using constant communication, strict policy, embedded controls, and the right tools and technology. Invest in these tools now, and make sure that they are in place for the upcoming budget season. Calendars, critical pathing, dependencies, sequencing, and transparency are the best practices to nailing the project management. Your company’s chosen budgeting software should have project management features built right in, or else you will need to manage this aspect manually or with another PM tool.

Manage backward from your board meetings, allowing time for preparation of materials, consolidation, C-suite review and adjustments, VP reviews, etc. If you are new to overseeing a budget cycle, reviewing prior year calendars can be helpful. Due dates should be realistic and allow for slippage (because…. hey, life happens). Buy in on calendar due dates is also key – people like to be part of the solution, not have deliverables forced upon them.

Finally, as a best practice seek to shorten planning cycles each year (incrementally) using these tools and processes. In a report from Radius Global Research in 2018, two-thirds of respondents said that their company’s financial planning, forecasting, and reporting processes were highly inefficient, with 25 percent complaining that their budgeting process takes four months or longer.

Relationships and partnering. In part one of this blog series, we mentioned root canals. When it comes to budgeting, there will always be a contingent of budget owners that look at the budget cycle with disdain and dread. Their view is that budgeting is an administrative activity, wrought with bureaucracy. They feel disconnected to outcomes (it is just a finance exercise, and my numbers never make it into the final version), and an intrusion into their ‘day job’. This is unfortunate, but common when relationships and partnering are not part of the broad planning design. With budget owners, make the process feel as least intrusive as possible, reduce strain and stress.

In fact, in using your budgeting software – ensure that the part(s) that they own are made completely clear, and as simple as possible to access and complete. By making budget owners jobs easier, they are more apt to put deliberate thought into the numbers rather than racing to just get numbers into an Excel template. They will budget for reality, not to please others.

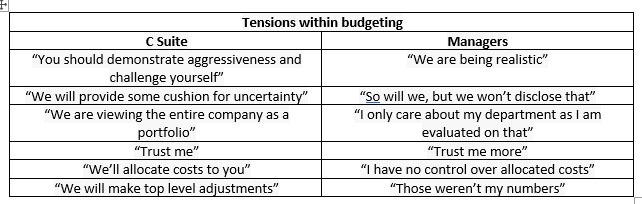

Do these tensions look familiar?

A best practice is finding the right balance of ‘top down and bottom up’. If your company does not choose to utilize Zero Based Budgeting, having an enterprise planning resource control for top down guidance (sales growth, merit increases, rents, depreciation ,taxes, etc.) ensures that there is no onus of judgement and interpretation on the individual budget owners. Once certain items have been adjusted for top down guidance, placing the templates into the hands of the budget owners to simply do ‘their part’ makes the whole experience much easier. Allow for budget owners to provide input where their operations and department may be unique, and their insight into those lines for the budget are crucial.

Next week, we will put a bow on this discussion with more best practices and how you can take your budgeting activities to the next level.