Priorities of the CFO are shifting. Today’s finance leaders aren’t just responsible for financial planning, budgeting, and reporting. They’re also often required to drive long-term business and operational initiatives that support the digital transformation every finance department is striving for these days. CFOs who do not have access to real-time reporting and financial analytics risk not being able to maneuver changing conditions in the marketplace. CFOs also risk exposure to bad data due to not utilizing the right technologies, which can erode an organization’s performance.

Customer preferences have been inevitably shaped by the pandemic. Now, customers have a greater expectancy for speed, multichannel delivery, and always-on availability. CFOs should begin to put more of a primary focus on identifying investments that will drive positive business outcomes and enhance the customer experience within new hybrid working models. In addition, CFOs need to reassess how to measure business performance in this altogether new environment while also encouraging new business models that support digital growth.

In today’s business climate, it is expected that the CFO leverage every aspect of the organization’s most relevant data to provide actionable insights. They NEED the right tools and technology to become the CFO that every CEO expects to have. But remember not all tools are designed for finance! Why? Because the common platforms built for business intelligence and analytics are often meant for broad, company-wide operational data and not as focused on the finance organization as they should be. Additionally, while some data sets will assist leadership in seeing from a variety of perspectives, on where the organization stands and where it is going, others will leave them drowning in a sea of overwhelming and potentially inaccurate data. So, how can you become the super CFO? Advanced data analytics could be your saving grace when it comes to being a hero.

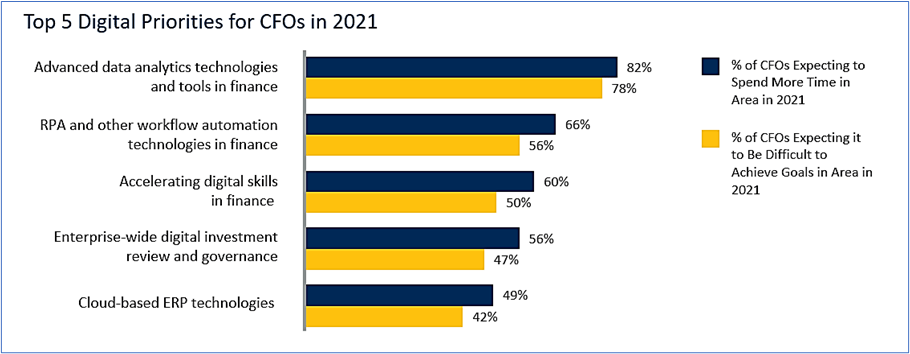

The COVID-19 pandemic has greatly impacted the digital transformation of organizations all around the world, as many were forced to assess their current digital capabilities. A recent survey by Gartner revealed that most CFOs are not confident in successfully meeting their highest priority digital objectives for the coming year. The survey asked CFOs where they plan on spending more time in 2021 compared to 2020, and where exactly they anticipate difficulties in achieving these goals. While 82% of respondents indicated that advanced data analytics technologies and tools were a top priority, nearly 78% expect the digital transformation to be difficult in order to achieve their goals. Those numbers are astounding. Nearly all CFOs want to implement change but are hesitant to do so because, yes, it can be hard.

Advanced Digital Analytics technology can help finance organizations deliver insights at scale and create long-term competitive advantages. “Most CFOs have by now conducted small-scale experiments in either RPA, AI, or advanced analytics technologies, and they have seen the potential for significant ROI” says Alexander Bant, Chief of Research in the Gartner Finance practice. “Now the key will be achieving scale with these technologies while ensuring that CFOs have the talent in place to run an always-on, fully digital business.”

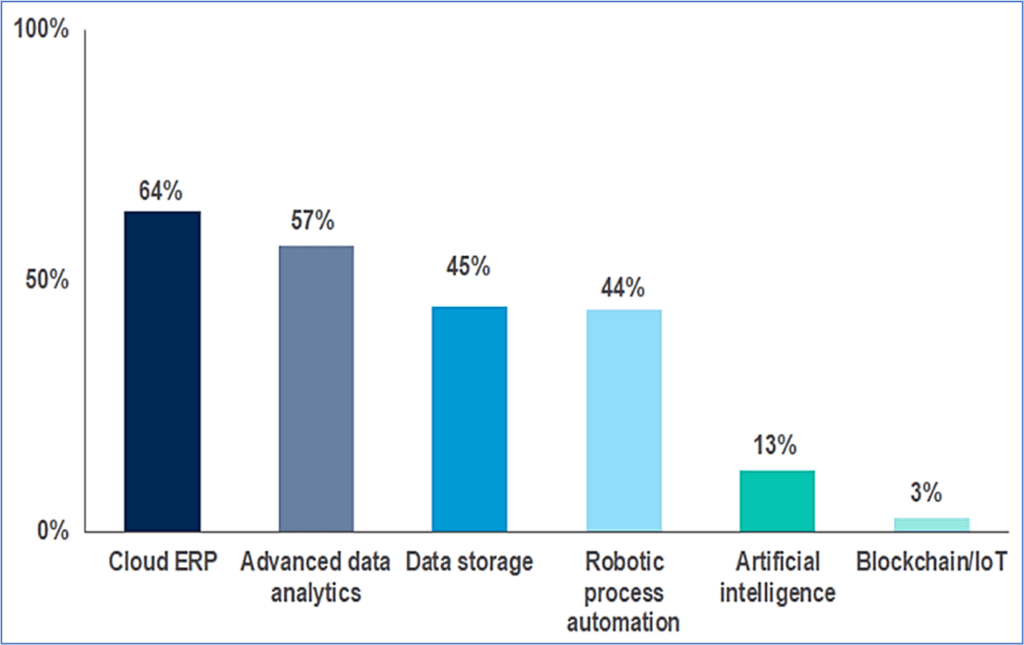

Another recent study by Gartner showed that Cloud ERP, advanced data analytics, and data storage are the most likely emerging technology investments for corporate finance through 2024. “Digital investment and transformation are no longer things that CFOs can take a ‘wait and see’ approach on or throw small investments at. The time is now, and CFOs need to act swiftly” says Dan Garvey, VP in the Gartner Finance practice. In other words, go big or go home. The pace of this digital transformation has changed dramatically, and it seems to be moving faster than ever.

Here are a few questions that today’s CFO should be asking about Data Analytics:

How is the data populated? Does it need to be imported/exported, or is it directly integrated with your reporting data with no manual intervention needed?

What’s involved in customizing the dashboard for the business? What will we measure to align with strategic decisions progress?

What’s our margin of error?

Is the data real-time or what’s the time lag?

How much custom work – time and money – is required to get the analytics that the organization needs? Does it include the specific industry data that we can benchmark against?

When new metrics or Key Performance Indicators (KPIs) are added, can our team add them, or do we need to call in consultants?

Can we integrate other operational data from outside our financials to keep a big picture view of our overall performance?

As you sift through these questions, consider AnalyticsFYI. At FYIsoft, we like to make things easier. We recognize that it’s hard to implement digital change into your organization and we bring a really strong analytics tool, like a “clip-on” for your ERP. This product was designed to specifically overcome all of these challenges and more. Built for finance, this powerful analytics tool is integrated with actual reporting data and fully loaded with preformulated dashboards, KPIs, ratios, and other metrics most commonly used by finance teams. Visit our website for a quick demo to see if we’re the right tool for you and your organization.