There is a VERY important financial metric that tends to fly under the radar for some CFOs. This metric is called ‘Degree of Operating Leverage’ (or DOL). The calculation itself is straightforward and easy to quickly calculate.

The % change in Earnings before Interest and Taxes (EBIT) as a ratio to the % change in revenue between two periods (typically a fiscal year). In a pinch, $ change in Operating Income can be a reasonable proxy for EBIT.

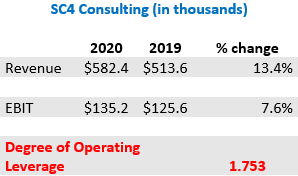

Here is a generic example of the calculation.

Ok. So what, you say. Decipher this measure.

This tells us the company’s operating risk as a result of the structure of fixed and variable costs. The measure helps us determine the impact of Year over Year changes in revenue on the company earnings. A high DOL is indicative of a high proportion of fixed costs to total costs.

Before we go any further, side-note – a fixed cost is one that, in the short run, does not change with factors of production. Think rent, salaried employees, or a monthly insurance premium. The expense ‘is what it is’, and changes in revenue do not typically influence. A variable cost, on the other hand, is tied (correlated) strongly to changes in revenue. Variable costs ride the roller coaster of revenue. Think raw materials for production, or electric bills that go up and down with factory usage. The busier the operations, the higher the expense. Got the theory? Back to DOL.

Degree of Operating Leverage is the proverbial ‘Canary in the Coal Mine’ for many CFOs. It is indicative of the double-edged sword of Fixed Costs. While a high proportion of fixed costs are wonderful in good times for a company – high increases in Revenues provide huge upside in profits since Fixed Costs stick where they are…. low times can be crushing for an organization with a high proportion fixed cost. Many organizations were forced to deal with this reality in 2020 during the darkest days of our national Covid-19 crisis. Revenue down 68%? Tough – pay your fixed costs. High DOL brings high risk, but high reward in certain conditions.

How should an CFO act upon Degrees of Operating Leverage? Having insight into Revenue expectations into short term futures should drive an organization to tactically manage their Fixed and Variable costs. A rosy picture of revenue growth should prompt a company to try to create as many fixed costs as possible in the ‘short term’ through thoughtful contracting and engagement of vendors and services. Things not looking so great. Unhook as many fixed costs as possible and shift to variable. An example would be to move off of fixed utility costs and tie to metered usage. Or shift new hires to hourly vs. salary. There is a myriad of choices to make in managing fixed and variable costs. Having awareness of your DOL history and outlook should be the impetus to review Fixed and Variable costs periodically.

How does one monitor these costs in a busy world with poor reporting tools? Allow us to shamelessly plug a product. ReportFYI from FYIsoft is a perfect solution to dynamically monitor and calculate such measures quickly and efficiently. In fact, ReportFYI is specifically designed to simplify financial reporting, especially for multi-entity and fast-growing companies that can barely keep up.

If you’re interested in looking at or creating quick scenarios in which you can play with different mixtures of Fixed and Variable costs you may want to look at BudgetFYI. And…if you’re interested in insights, visuals, benchmarking and what if tools in order to understand the hidden meaning behind your financials, then you may want to demo our analytics product, AnalyticsFYI. Together, these three products provide all the firepower you’ll ever need in a financial reporting, budgeting and analysis troika.