How to Eliminate the Financial Reporting Excel Dump

For companies with complex reporting needs like multi-company consolidations, nothing will compromise a financial close like spreadsheets. For many that rely on Excel-based reporting processes,

For companies with complex reporting needs like multi-company consolidations, nothing will compromise a financial close like spreadsheets. For many that rely on Excel-based reporting processes,

With the new year comes a new era in financial reporting. The financial industry is dynamic with new trends continually emerging. The summary below includes

Naples, FL, USA – September 12, 2023 – FYIsoft, a provider of cloud-based solutions for financial reporting, analytics, and budgeting, today announced the availability of

One of the most memorable moments of the 2022 Summit Keynote address was the big announcement: GP has joined the list of legacy Microsoft ERPs

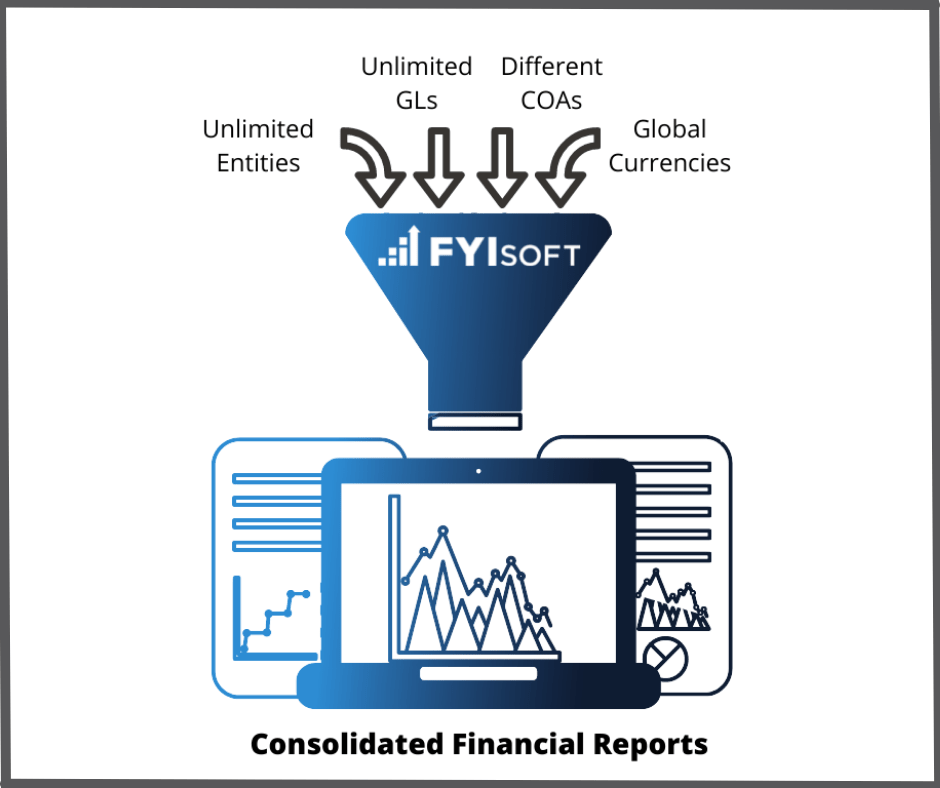

If you are exploring financial reporting and FP&A solutions, you are probably familiar with the growing popularity of the phrase, “multiple GL consolidation.” It’s true

Naples, FL – May 3, 2022 – FYIsoft’s suite of financial reporting and FP&A solutions integrate with many ERP systems to deliver the modern automation

Naples, FL – May 2, 2022 – FYIsoft, a provider of financial reporting and FP&A software, announces three new product releases completed during the first

Naples, FL – March 29, 2022 – FYIsoft has been named a Rising Star in the Financial Close Management Software category for the Spring 2022

Built on the UiPath end-to-end enterprise automation platform, FYIApps complement FYIsoft’s unified suite of financial reporting, budgeting, and analytics solutions, providing additional automation power to

A CIO advisory firm recently revealed the core 2022 finance transformation goals for CFOs and CIOs. Below is a summary of four of the most